Take home after taxes calculator

This places US on the 4th place out of. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

. Check your tax code - you may be owed 1000s. When you make a pre-tax contribution to your. How to calculate annual income.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Notice the 0 tax rate for all individuals earning less than 10347. Actual rent paid minus 10 of the basic salary.

Financial Facts About the US. Your household income location filing status and number of personal exemptions. Some states follow the federal tax.

There was a shocking discrepancy between the pre-tax and the take-home numbers. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. You can see Germanys progressive tax rates in action here.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Plug in the amount of money youd like to take home. How much youre actually taxed depends on various factors such as your marital.

Calculate your take home pay in the Netherlands thats your salary after tax with the Netherlands Salary Calculator including tax adjustments for expats subject to the Dutch 30 rule. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. The latest budget information from April 2022 is used to.

It can also be used to help fill steps 3 and 4 of a W-4 form. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The 15525k after tax take home pay illustration provides a salary calculation for an Australian resident earning 15525000 per annum and assumes private medicare provisions have been.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. With our tax calculator find out what is your take home pay net wage from a gross salary of 30000000000000000 using Income Tax Calcuator. The state tax year is also 12 months but it differs from state to state.

For example if an employee earns 1500. That means that your net pay will be 37957 per year or 3163 per month. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Transfer unused allowance to your spouse. Free tax code calculator.

Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out. 50 of the basic salary if staying in a metro city and 40 in a non-metro city. Then from 10348 all the way up to 58596 it scales.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate Income tax by applying. Reduce tax if you wearwore a uniform.

Avanti Gross Salary Calculator

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

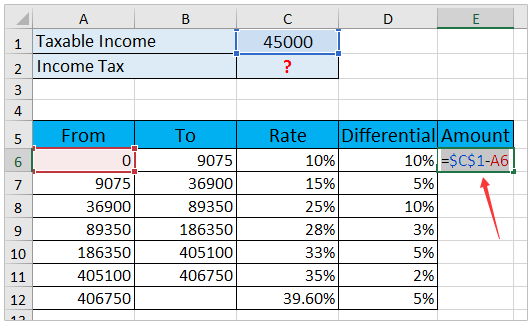

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

2021 2022 Income Tax Calculator Canada Wowa Ca

Ontario Income Tax Calculator Wowa Ca

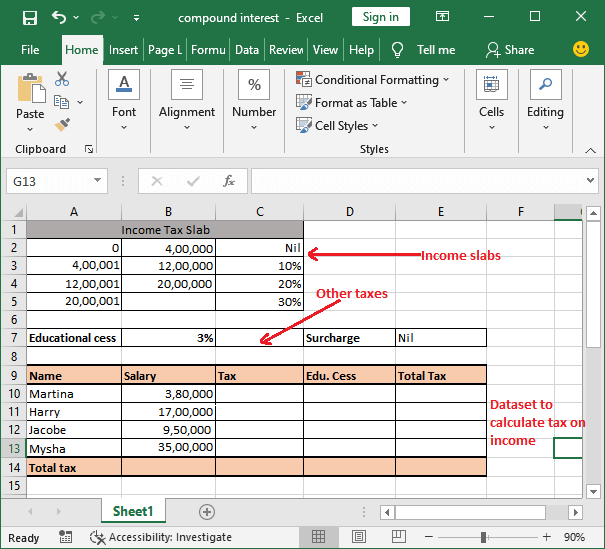

How To Calculate Income Tax In Excel

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Income Tax In Excel

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

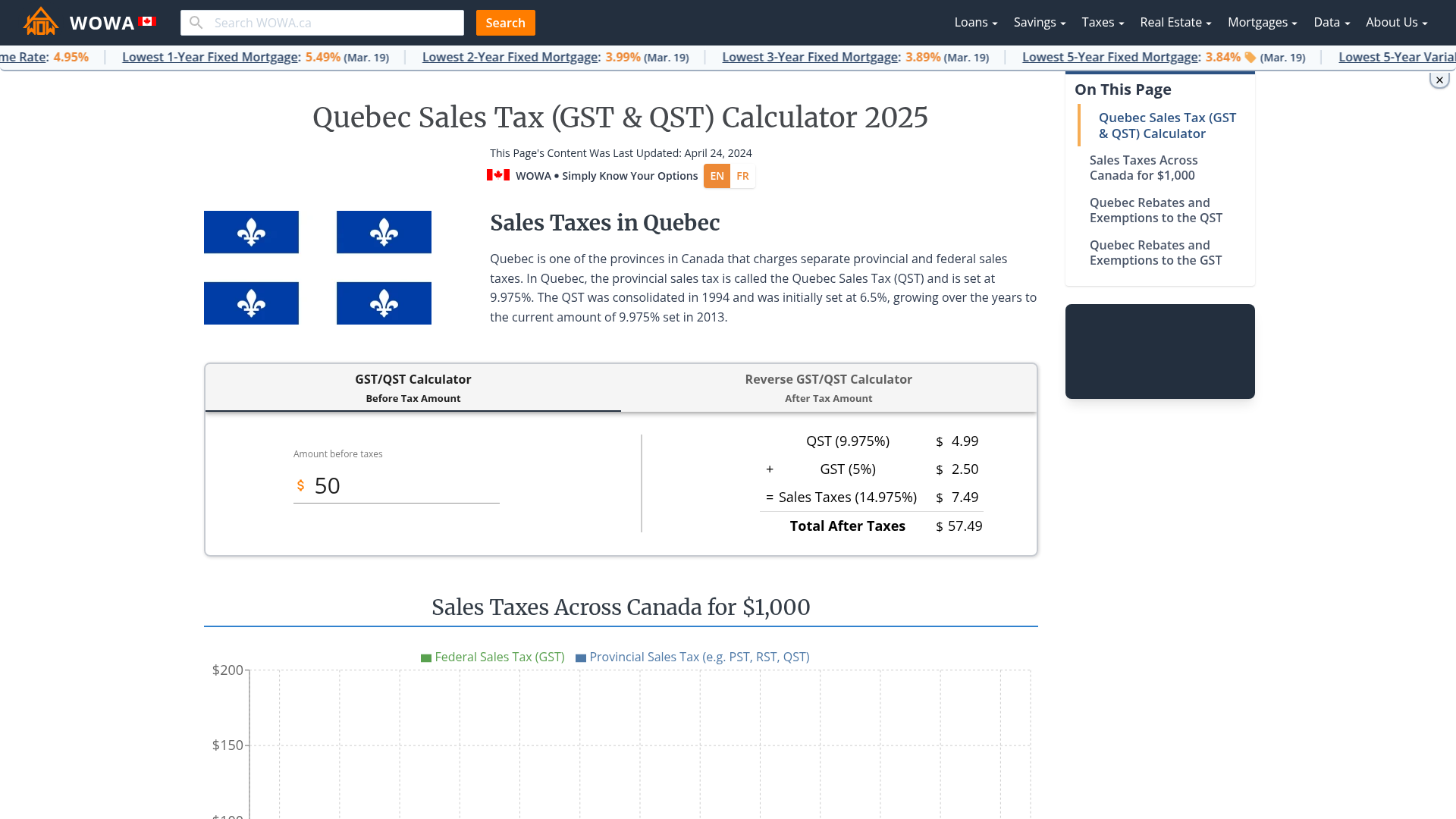

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Calculating Formula In Excel Javatpoint

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Canada Capital Gains Tax Calculator 2022